(Back to the Guide to Texas School Finance)

Maintenance and Operations (M&O)

Property Tax Rate Compression

(last updated 12/17/2021)

Overview

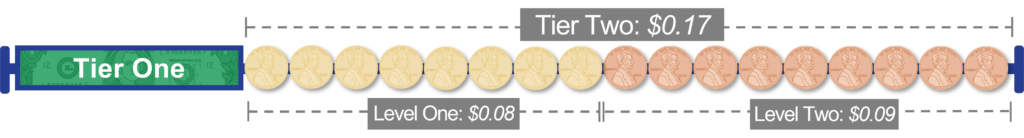

House Bill 3 (2019 – 86th, Regular) created various mechanisms to compress school districts’ maintenance and operations (M&O) property tax rates. The bill included different formulas for compression of both the Tier One and the Tier Two, Level Two (also referred to as copper pennies) portions of the M&O tax rate.

Prior to HB 3, the highest M&O tax rate nearly all school districts in Texas could adopt was $1.17.

- The first $1.00 of the M&O rate was defined as the Tier One portion of the tax rate. Prior to HB 3, nearly every school district in the state had a Tier One rate of $1.00. HB 3 included formulas to compress this portion of the tax rate depending on estimated statewide property value growth and local property value growth.

- School districts can choose to adopt up to 17 additional pennies on top of Tier One. This portion of the rate is referred to as Tier Two or the “enrichment” rate. Around 35 percent of districts had adopted all 17 Tier Two pennies prior to HB 3. HB 3 defined the first 8 pennies of Tier Two as Level One (also referred to as “golden” pennies) and the next 9 pennies as Level Two (also referred to as “copper” pennies).

There is no compression for Tier Two, Level One. There is compression for the Tier Two, Level Two portion of the tax rate. Compression in that level is now contingent on future increases to the basic allotment (i.e. if the basic allotment is increased above $6,160).

For more on M&O tax rates and tax rate adoption, click here. For more on HB 3 (2019 – 86th, Regular) , click here.

Tier One Compression

The Tier One portion of school districts’ M&O tax rate is subject to compression as determined by various statutory formulas.1 These formulas depend on two main factors:

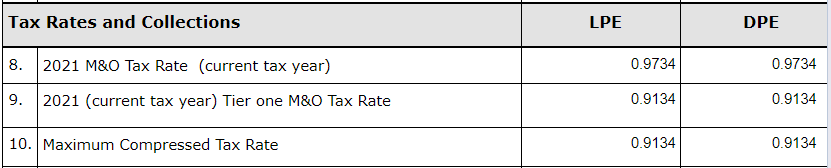

These formulas calculate what is called the Maximum Compressed Rate or MCR. The MCR is the lesser of the compression rate calculated from estimated statewide growth or local property value growth. MCRs are inversely related to property value growth. The more statewide or local property value growth there is, the lower the MCR will be under the statutory formulas.

School districts with little property value growth or even property value declines may still see a reduction in their MCR (i.e. compression of the Tier One portion of their tax rate) because of statewide compression. Under state law, MCRs cannot be increased from the prior year.

School districts with moderate or strong property value growth may see additional compression on top of what is required due to statewide compression.

Districts can find their MCR and their Tier One rate on the Summary of Finance report from TEA (see lines 9 and 10).

The MCR acts as a ceiling on districts’ Tier One rate. The Tier One rate cannot exceed the MCR, and districts cannot propose or adopt a tax rate more than $0.17 above their MCR.2 For more on district tax rate adoption, click here.

Districts can adopt a tax rate below their MCR, but this will result in a proportional reduction to the basic allotment amount used to calculate their entitlement under the Foundation School Program. In short, districts will lose money under the school finance system for doing so.

It is important to note that the Tier One rate capped by the MCR is part of what determines school districts’ Local Fund Assignment, or the portion of the Tier One entitlement that the school district must pay for on its own. So, as the MCR is compressed and the Tier One rate is reduced, more of the cost for funding the Foundation School Program is shifted to the state. On its own, Tier One rate compression does not reduce funding to schools.

For more on how the costs of public education in Texas are split between local school districts and the state, click here.

Estimated Statewide Property Value Growth

The estimates for statewide property value growth are provided to lawmakers by the Comptroller of Public Accounts prior to and during each legislative session. Occasionally, revisions and updates are made to these estimates as well.

Once finalized, the statewide property value growth estimate can be found listed in the Foundation School Program Funding rider in TEA’s section of the state budget. Current and historical growth estimates used for compression are listed below:

| School Year | Statewide Annual Growth Estimate |

|---|---|

| 2020-21 | 4.01% |

| 2021-22 | 1.84% |

| 2022-23 | 4.36% |

These estimates are used to calculate the State Compression Percentage. The State Compression Percentage acts as the minimum amount of Tier One rate compression for all school districts, regardless of their local property value growth.

If the Comptroller’s office forecasts growth in excess of 2.5%, then there is a reduction to the State Compression Percentage. If the growth forecast is less than 2.5%, then the statutory formulas would not require a reduction to the State Compression Percentage.

The Legislature can also choose to fund additional statewide rate compression above what is provided through the statutory formulas, as they did in the 2022-23 General Appropriations Act (see bottom-third of page 234 in the paragraph beginning with “Pursuant to Section 48.2552(c)”).

For example, the growth estimate for the 2021-22 school year was less than 2.5%. On its own, this would not have triggered a reduction in the State Compression Percentage. However, the Legislature funded an additional 0.3% reduction to the State Compression Percentage. This brought the State Compression Percentage down from 91.64% to 91.34%.

Historical and projected value growth estimates and their impacts on the State Compression Percentages are included in this table.

Local Property Value Growth

Texas school districts may see additional compression of their Tier One rate if the year-over-year growth rate of their local property values exceeds 2.5%. Annual local property value growth is based on data submitted to TEA on the Local Property Value Survey (LPVS). For more on the LPVS, skip to this section.

State law sets a floor for Tier One rate compression: No school district can have an MCR that is less than 90 percent of the highest MCR. This acts as a “circuit-breaker” for tax compression and was included to help shield the state from charges of establishing an inequitable school finance system.

Tier One Compression Examples

The animation below shows an example of how the Tier One compression formulas worked during the 2020-21 school year, which was the first year both statewide compression and local compression formulas were in effect.

Animations for additional school years can be found below:

Local Property Value Survey

TEA calculates local property value growth based on data school districts submit through the Local Property Value Survey (LPVS). Districts must submit the following information from the previous and current tax year:

Previous Tax Year

Current Tax Year

- July 25th Certified Taxable Values

- Local Optional Homestead Exemption Loss (if applicable)

- Value no longer subject to 313/311 limitations (if applicable)

The certified taxable values reported to TEA on the LPVS should be:

- Grand Total: Include both ARB-approved values and values under ARB review

- Net Taxable: Include value of frozen properties. Districts should not submit freeze-adjusted values on the LPVS.

- As of the Final Certification Date: As noted above, the values submitted to TEA on the LPVS should be as of the appraisal districts final certification date. State law sets the certification deadline on July 25th.3 Once MCRs are finalized through the LPVS, any change to the district’s taxable value will not impact the district’s tax rate.

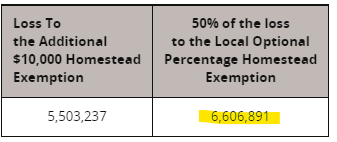

The local optional homestead exemption loss reported to TEA on the LPVS should be related to the exemption allowed under Texas Tax Code §11.13(n). This is the optional exemption of up to 20% that school districts can give to owners of residence homesteads in their district. School boards must adopt this exemption on their own. Currently, around one-third of districts across the state have done so.

You can see if your district currently offers a local optional homestead exemption on the Comptroller’s Property Value Study website (click the “School District PVS Findings” dropdown and then find the “School District Summary Worksheet” for your district in the applicable year). If you have a local optional homestead exemption, it will be reflected in the highlighted cell of the table below:

PLEASE NOTE: The value highlighted in the table above is only 50 percent of your value loss due to the local optional homestead exemption. You will want to have your county appraisal district assist you with identifying the full loss amount as of certification for the current and previous tax years. Usually, these are listed under the “Local” column of the deductions report page provided at certification.

Districts need to provide TEA with the full value loss of any local optional homestead exemption adopted.

Districts should not report the value loss from the state mandated homestead exemption required under Texas Tax Code §11.13(b) (i.e. the loss due to the $25,000 — and soon to be $40,000 — state mandated homestead exemption) on the LPVS.

The value no longer subject to 313/311 limitations reported on the LPVS should be the value of any properties in the first year after the expiration of any 313/311 limitation previously in place. This is not a data element that is readily monitored by the Comptroller’s office or TEA so districts will have to rely on their local county appraisal districts or outside consultants to help determine if this applies to them.

Tier Two, Level Two “Copper Penny” Compression

The Tier Two, Level Two portion of school districts’ M&O tax rates is subject to compression if the Legislature increases the guaranteed yield for Tier Two, Level Two (i.e. “copper”) pennies. This guaranteed yield amount is tied to the basic allotment, which is currently set at $6,160. As a result, if the basic allotment is increased, that will trigger additional copper penny compression.

For more on the basic allotment, click here. For more on Tier Two, click here.

The compression amount is defined as the ratio between the old copper penny yield and the new copper penny yield. HB 3 increased the yield from $31.95 to $49.28.

$31.95 / $49.28 = 64.83%

This resulted in a 64.83% reduction to any copper pennies adopted by Texas school districts. A district with $0.09 copper pennies, for example, had $0.0583 after HB 3 compression (TEA truncates down to 4 decimal places).

Resources

- TEA’s Tax Rate and MCR Template: This tool can help districts forecast and plan for the results of the Local Property Value Survey.

- HB 3 in 30 Video Series: During the initial implementation period of HB 3, TEA released several videos including Tax Rate Changes and Tax Compression Part 2.

- Local Property Value Survey (TEAL log-in required): This is the agency application for districts to submit the local property value information needed for TEA to calculate the maximum compressed rates for Texas public school districts.

State Compression Percentages

| School Year | State Compression Percentage | Notes |

|---|---|---|

| 2019-20 | 93.00% | HB 3 uniformly set the state compression percentage at 93% in the bill’s first year of implementation. |

| 2020-21 | 91.64% | Estimated growth of 4.01% resulted in a reduction of the SCP. |

| 2021-22 | 91.34% | Estimated growth of 1.84% did not cause reduction to the SCP from the formula in state law (since it was less than 2.5%). However, the Legislature appropriated additional funding to pay for a reduction of 0.3 percentage points from the SCP. |

| 2022-23 | 89.41% | Estimated growth of 4.36% will result in a reduction to the SCP due to the formula in state law (since it was greater than 2.5%). Statutory formulas would have resulted in and SCP of 89.71%. However, the Legislature has appropriated additional funding to pay for another reduction of 0.3 percentage points from the SCP in this year as well. As a result, the final SCP for the 2022-23 school year is projected to be 89.41%. |

Footnotes

1 These formulas are included in TEC §48.255, 48.2551, and 48.2552.

2 Some Harris County-area school districts have special permission under to adopt more than $0.17 Tier Two pennies.

3 See Texas Tax Code §26.01(a).